Entry of Japanese companies into India slow in last 3-4 years, Indian Govt told yet again to act in earnest

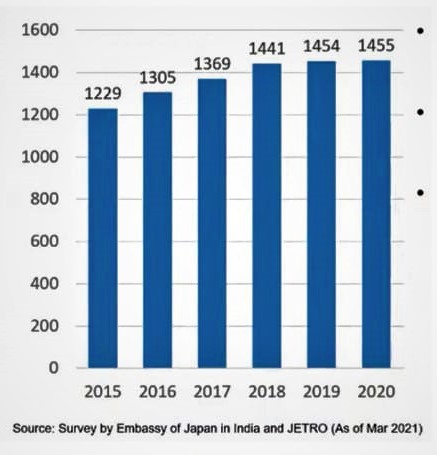

NEW DELHI: The entry of Japanese companies into India has been slow for the past three to four years as the total number of Japanese companies operating in India could move up marginally by four companies since 2018, notwithstanding the impact of the global pandemic.

.The 4th largest foreign investor in India after the USA, UK, and China, Japan had a total number of 1441 companies operating in 2018, but this figure could swell to 1455 only in 2020, as per the figures released jointly by the Embassy of Japan and Japan External Trade Organisation (JETRO).

The last major jump was witnessed in the year 2017-2018 when the total number of Japanese companies had increased to 1441 from the previous year’s figure of 1369, an addition of 72companies.

The last major jump was witnessed in the year 2017-2018 when the total number of Japanese companies had increased to 1441 from the previous year’s figure of 1369, an addition of 72companies.

However, sources in the Japanese circle claimed that about 20 odd Japanese companies entered India in the last one to two years but the total number could not increase much as the almost same number of companies, especially in the service sector shut down their operations due to Corona pandemic.

In a strong-worded suggestions letter written by the Japan Chamber of Commerce and Industry in India (JCCII) to the Department for Promotion of Industry and Internal Trade (DPIIT), the Ministry of Commerce and Industry recently, said, “In terms of cumulative FDI over the past seven years, Japan’s investment in India ranks 4th after the US, UK, and China. However, it is still limited compared to investment in East Asia. In addition, the number of Japanese companies operating in India has been stagnant for the past 3-4 years, notwithstanding the impact of the global pandemic.”

Related article: For Japanese companies, India a tough place to do business compared to ASEAN

Over the past nine years, the JCCII represents over 455 Japanese companies in Delhi and NCR has been submitting an annual “Suggestions for the Government of India” to the DPIIT.

However, the JCCI also submitted reasons also behind this fiasco.

“There are several reasons for this such as comparison with the business environment in southeast Asia, heavy emphasis on automotive-related investments, negative image of India due to past experience of failure, skepticism about large-scale investments in terms of various country-specific risks, and limited investment in digital fields and start-ups,” stated the letter, which is in the possession of Asian Community News (ACN) Network.

In order to address such issues, the JCCI also suggested the ministry and urged it to consider a proactive response to key underlying issues such as the development of economic and social infrastructure, deregulation of the financial sector, and efficiencies in cumbersome taxation, BIS, customs, and other trade procedures, which have long been impediments for Japanese companies hoping to serve and do business in India.

Related article: Japan reminds India again: Many of 200 Japanese investment plans delayed, postponed; provide ideal biz environment to restore them

“If these issues can be addressed actively, India will surely attract not only Japanese companies but also a wider range of foreign investment,” it added.

However, the Japanese trade association also highlighted certain positive developments happening in India with regard to the Japanese investment in non-conventional sectors during the pandemic-struck year.

“JCCI At the same time, even during the pandemic we have witnessed a diversification of investment, including large-scale investments in the financial and real estate sectors, foodservice and retail industries, and the entry of start-ups. In order to further increase investment, we believe steps are required to better improve the business environment in India. We believe it is essential for us to contribute to the development and advancement of Indian industry in cooperation with the Indian government,” the letter stated.

[…] Related article: Entry of Japanese companies into India slow in last 3-4 years, Indian Govt told yet again to act in … […]