Hyundai Motor Unveils New ‘Hyundai Way’ Strategy at 2024 CEO Investor Day in Seoul

While outlining its Mid-to-Long-Term Goals, the company said it is targeting 5.55 million annual global sales by 2030, up 30% from 2023, and is aiming to sell 2 million EVs per year globally by 2030.

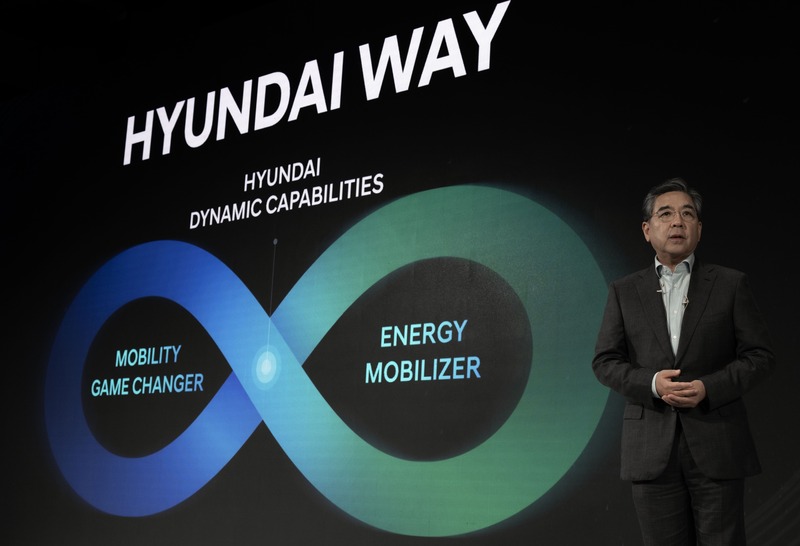

SEOUL, August 28, 2024 – Hyundai Motor Company hosted its 2024 CEO Investor Day today, unveiling its new mid- to long-term strategy, the ‘Hyundai Way’.

At the event, the company disclosed its commitment to enhancing its electric vehicle (EV) and hybrid competitiveness, advancing its battery and autonomous vehicle technologies, and expanding its vision as an energy mobilizer, responding to the market environment flexibly with its dynamic capabilities.

“Under the Hyundai Way, we will respond to the market with agility thanks to Hyundai’s unique flexible response system. This will secure sustainable leadership in an uncertain market environment and strategically position the company to create a future centered on mobility and energy,” said Jaehoon Chang, President and CEO of Hyundai Motor Company.

“Hyundai will strengthen its position as a game changer by expanding beyond vehicle manufacturing to various forms of mobility. By enhancing the role of energy business operators and realizing a hydrogen society, we intend to transform into a company that can maintain global top-tier leadership in the era of energy transition.”

In 2024, Hyundai Motor secured its profitability and EV competitiveness in the market. These achievements were recognized by global rating agencies as the company earned an ‘A-grade’ credit rating from major global credit rating agencies. Moreover, with a global sales annual volume of 4.21 million units in 2023, Hyundai Motor helped Hyundai Motor Group to become one of the top three automakers globally.

Implementing a full hybrid lineup expansion and next-generation TMED-II hybrid system: Hyundai Motor has been at the forefront of the hybrid market for years with its proprietary TMED hybrid system. The company intends to leverage its expertise to further bolster its position in the hybrid market under its new Hyundai Dynamic Capabilities strategy, a flexible response to the market based on core capabilities.

Under this strategy, the company will expand the application of its hybrid system beyond compact and midsize cars to small, large and luxury vehicles, effectively doubling its current range from seven to 14 models. This expansion will encompass not only Hyundai vehicles but also its luxury brand, Genesis, which will offer a hybrid option for all models, excluding those that are exclusively electric.

The company will also introduce the next-generation TMED-II system. This enhanced version of its existing hybrid system has achieved the world’s highest level of competitiveness by significantly improving performance and fuel efficiency compared to the existing system. This system is slated for integration into production vehicles starting from January 2025. Future hybrid vehicles will be equipped with premium technologies such as smart regenerative braking and V2L, enhancing product value and cementing Hyundai Motor’s standing in the market with superior product quality.

Leveraging its enhanced hybrid capabilities, Hyundai Motor aims to significantly boost the sales of its hybrid vehicles. By 2028, its goal is to sell 1.33 million units, an increase of over 40 percent of its global sales plan from the previous year. The company anticipates a surge in hybrid demand, particularly in North America, where it plans to increase its hybrid vehicle volume to 690,000 units by 2030. It will tailor its hybrid sales expansion to meet the demand in each region, including Korea and Europe. The expanded regional hybrid deployment plan will secure market portfolio flexibility.

To facilitate this ambitious plan, Hyundai Motor has secured a versatile production system and parts supply network, making full use of its major global factories and introducing hybrid models, resulting in cost reduction and profitability enhancement. Furthermore, it plans to manufacture hybrid vehicles at Hyundai Motor Group Metaplant America (HMGMA) in Georgia, U.S., alongside its dedicated EV models, including IONIQ 5 and IONIQ 9, the company’s highly anticipated, three-row fully electric SUV. This strategy will allow the company to respond swiftly to the North American market, which currently faces a shortage of hybrid supply, and to enhance the operational efficiency of the factory.

Rolling out a full EV lineup expansion and new EREV: In response to the recent slowdown in EV demand, Hyundai Motor is developing a new EREV under its Hyundai Dynamic Capabilities strategy. The new EREV will combine the advantages of internal combustion engines (ICE) and EVs. Hyundai Motor has developed a unique new powertrain and power electronics (PT/PE) system to enable four-wheel drive with the application of two motors. The operation is powered solely by electricity, similar to EVs, with the engine being used only for battery charging.

‘Hyundai Way’ Detailed Strategies & Targets

| ‘Hyundai Way’ Detailed Strategies | Sales & Financial Targets |

| ○ Hyundai Dynamic Capabilities

‒ Expand hybrid lineup from 7 to 14 models (incl Genesis) ‒ New EREV to serve as key bridge to full electrification ‒ Full EV lineup of 21 models by 2030 ‒ Develop new affordable NCM battery & safety tech

○ Mobility Game Changer ‒ Autonomous vehicle foundry business ‒ Next-generation infotainment system & open ecosystem ‒ Reveal SDV Pace Car equipped with High-Performance Vehicle Computer (HPVC) architecture in 2026

○ Energy Mobilizer ‒ Expand the HTWO fuel cell system lineup ‒ Clean logistics business starting with HMGMA |

○ Global Sales Targets

‒ 5.55 million units by 2030 ‒ 2 million EV sales by 2030

○ Mid-to long-term Investment Plans ‒ Total: KRW 120.5 trillion (2024 ~ 2033) ▲ R&D KRW 54.5 trillion ▲ CAPEX KRW 51.6 trillion ▲ Strategic Investment KRW 14.4 trillion

○ Profitability Target ‒ 2030 OP margin over 10% (consolidated basis)

○ Expanding Shareholder Return Policy ‒ 2024 annual dividend: min. KRW 10,000 ‒ 2025 – 2027 New total shareholder return (TSR) concept: 35%+ Target annual average ROE 11 ~ 12% Quarterly dividend of KRW 2,500 |

The new EREV maximizes the use of the existing engine to improve customer appeal and secure cost competitiveness with similar EVs by reducing high-cost battery capacity. It provides EREV customers with a responsive EV-like driving experience, allowing consumers to naturally transition to EVs during future demand recovery periods. The new EREV also offers price competitiveness over EVs through battery capacity optimization and allows both refueling and stress-free charging while offering a superior driving range of over 900 km when fully charged. This vehicle serves as a key bridge to electrification.

Hyundai Motor plans to begin mass production of the new EREV in North America and China by the end of 2026, with sales commencing in earnest in 2027. In the North American market, the company will initially launch D-class SUV models of Hyundai and Genesis brands to meet the remaining demand for internal combustion engines, with a target of 80,000-plus units.

In China, where price competitiveness is crucial in the eco-friendly car market, Hyundai Motor plans to respond using an economical C-segment platform, with a target of 30,000-plus units. The company will also review further expansion plans in line with future market conditions.

The company aims to address the EV deceleration by expanding its hybrid and new EREV offerings and gradually increasing EV models by 2030 when a recovery in EV demand is expected. Hyundai Motor aims to build a full lineup of EVs, from affordable EVs to luxury and high-performance models, and launch 21 models by 2030 to provide consumers with various options.

Hyundai Motor has been solidifying its position in the EV market with its IONIQ mass-market EV lineup. Through the expansion of the EV lineup in Genesis, a luxury brand, the company will continue to uphold its luxury brand value established in the ICE market.

Beginning with the GV60 Magma Concept revealed in New York last March, Hyundai Motor will open a new chapter of high-performance luxury by providing high-performance models that maximize quality and performance. The N brand will continue to expand its high-performance EVs, allowing the company to further enhance its strong competitiveness in core EV technology.

In the ICE era, it took nearly 100 years for mass-market car brands to expand into luxury and high-performance. However, in the EV era, Hyundai Motor has shown the fastest lineup expansion, not only for mass-market brands but also for luxury and high-performance models. Leveraging its top-tier technology and commitment to innovation, Hyundai Motor will continue to prepare for the upcoming era of electrification and lead the EV market.

“In the electrification era, Hyundai has distinguished itself by rapidly launching a comprehensive lineup of EVs, catering not only to mass-market brands but also to the luxury and high-performance segments,” said President Chang. “Building on our advanced technology and dedication to innovation, we aim to secure a leading position in the market as the adoption of electrified vehicles gains momentum.”

Growing sales through increased production and diversifying businesses and services:

Hyundai Motor is making significant strides in its quest to become a global top-tier player in the EV market. By 2030, Hyundai Motor aims to add 1 million units of production capacity to sell 5.55 million vehicles globally. The company plans to lead the automotive industry while expanding into new business and service areas. As part of this plan, Hyundai Motor is targeting sales of 2 million EVs by 2030, further cementing its global EV leadership.

To achieve its sales targets, Hyundai Motor will open the aforementioned HMGMA ahead of schedule in 2024 and a dedicated EV factory in Ulsan by 2026, adding a production capacity of 500,000 units.

To bolster its presence in rapidly growing emerging markets, Hyundai Motor has acquired the Pune factory in India, enabling the establishment of a production system capable of producing 1 million units. Also, the company plans to maximize the utilization of its facilities in China and Indonesia while actively expanding its market share through its CKD (Complete Knock-Down) business across the Middle East, Asia-Pacific and other regions.

Hyundai Motor’s production goals are underpinned by its commitment to manufacturing innovation, as demonstrated at the Hyundai Motor Group Innovation Center Singapore (HMGICS). This smart factory, dedicated to transforming the way Hyundai Motor produces vehicles, integrates various cutting-edge technologies such as robotics, artificial intelligence and advanced vision systems, serving as a test bed for smart manufacturing techniques.

This commitment extends globally as Hyundai Motor actively expands HMGICS’ innovative production technologies from HMGMA to other global manufacturing sites. The adoption of advanced vision technology will further enhance product quality. Hyundai Motor is also incorporating logistics robots into its existing facilities, such as in Ulsan.

By leveraging its extensive experience in producing high-quality vehicles and integrating new technologies, Hyundai Motor is driving manufacturing innovation based on data-driven insights. It is actively responding to customer preferences, recognizing that while EVs are the future of transportation, not all customers are ready to make the switch. Hence, it continues to offer a range of powertrains, including ICE, hybrids, plug-in hybrids, EVs and hydrogen fuel cell vehicles.

As Hyundai Motor expands globally, the company is leveraging the Group’s engineering prowess and localizing vehicles to meet specific customer tastes and regulatory requirements. This includes adding hybrid production to HMGMA and introducing hybrid options for Genesis.

Hyundai Motor also is strengthening its global presence by empowering regional organizations, particularly in North America, with strategies to improve dealer relationships, customer experience and regional demand fulfillment. This includes optimizing inventory distribution, manufacturing footprint, innovative marketing, new mobility offerings and strategic partnerships.

In North America, the company is achieving record-breaking sales for its EVs and hybrids through superior vehicle design and price competitiveness. In Europe, Hyundai Motor is expanding its dealer network and sales organization. The company is also making strides in key emerging markets in the Middle East, South America, and Asia, with initiatives such as constructing a new production plant in Saudi Arabia, regionalizing its product lineup in South America, and establishing new sales offices in Asia. Partnerships with entities like LG Energy Solution are also contributing to its global growth.

Strengthening battery competitiveness through technology diversity, safety and quality: Hyundai Motor is planning to secure battery technology differentiation, strengthen battery competitiveness, and advance battery safety technologies under its Hyundai Dynamic Capabilities strategy to become the only OEM in the world with a full battery lineup across multiple powertrains.

The battery, a crucial safety component in EVs, constitutes the largest portion of EV costs and greatly influences cost competitiveness. As the only global automaker with a full battery system lineup, Hyundai Motor is dedicated not only to improving battery performance but also to ensuring that EVs are affordable, safe and easy to maintain. This commitment is rooted in the company’s inherent capability for battery development. The company continuously works to enhance battery cell competitiveness and safety technology, aiming to deliver maximum customer value and internalize battery development capabilities.

Hyundai Motor plans to expedite the development of next-generation batteries, including solid-state batteries. The company is set to continue development in its next-generation battery research building, which is scheduled to open at Hyundai Motor’s Uiwang Research Institute later this year. This initiative is aimed at reinforcing the company’s leadership in next-generation battery technology.

The company also plans to apply the battery CTV (cell-to-vehicle) structure optimized for the company. In the CTV structure, by integrating the battery and the vehicle body, the company can improve battery integration and performance, reduce parts to lighten the weight by 10 percent compared to the previous CTP (cell-to-pack) system.

By 2030, Hyundai Motor aims to not only use current performance-based NCM (nickel-cobalt-manganese) batteries and low-cost LFP (lithium-iron-phosphate) batteries but also develop a new, affordable NCM battery to provide a wider range of solutions. This new entry-level battery will first be implemented in volume models, with the company anticipating a battery performance enhancement of over 20 percent by 2030, through ongoing improvements in battery energy density.

Hyundai Motor is also continually advancing its battery safety. The company has already applied battery management system (BMS) pre-diagnosis technology to its EVs that detects minor battery abnormalities in real time and alerts the user. The company will expand to battery life management functions based on AI models and improve the accuracy of battery life prediction technology.

Hyundai Motor has developed a battery system safety structure that prevents heat transfer between battery cells, regardless of the battery form factor, and has continuously applied improved technology to vehicles. Moreover, the company is developing an advanced cooling technology that suppresses the occurrence of flames inside the battery and aims to apply it to mass-produced vehicles by 2026.

Drawing on the technical know-how acquired through battery design, Hyundai Motor will provide consumers with safer and more refined EVs. This commitment to innovation, quality and safety underscores the company’s dedication to leading the way in the EV market.

Mobility Game Changer: Hyundai Motor’s software-centric shift and SDV Pace Car: In the second part of the Hyundai Way, the Mobility Game Changer strategy outlines Hyundai Motor’s software (SW)-centric transition strategy. The company is continuously enhancing its products and services based on SW and AI. It focuses on the development of Software-Defined Vehicles (SDVs), including an SDV Pace Car, and new mobility businesses, leading the transformation in the mobility ecosystem.

Hyundai Motor is transitioning to a development system for SDVs by incorporating software development methods into vehicle development. The core of SDV development includes the creation of hardware devices that can collect a variety of data from inside and outside the vehicle, and the ability to control the overall vehicle interface based on software. The company aims to connect SDV devices with fleets, logistics and urban transportation infrastructure, building a data infrastructure that can generate, collect, and utilize large amounts of data in various fields.

Utilizing AI and digital twin technology, Hyundai Motor will efficiently manage the real-time operation status of various mobilities and traffic conditions. The company will continuously enhance cybersecurity technology to develop safer and more reliable connected services.

Furthermore, by offering a third-party software developer kit (SDK) and app market, numerous IT developers and mobility service providers will be able to develop various services using Hyundai Motor’s data infrastructure. This will contribute to the creation of the SDV future mobility ecosystem, based on 42dot’s SW technology platform.

Hyundai Motor is developing a Zonal Electric-Electronic (E/E) architecture based on a high-performance vehicle computer (HPVC) for optimized SDV devices in terms of power, control and communication. The application of such an architecture can simplify the existing complex vehicle structure, reducing development time and cost, and increasing the flexibility of software changes, enabling faster improvement and deployment of services and functions.

The company is also building a next-generation infotainment system and an open ecosystem to provide a user-centric usage environment. For this, Hyundai Motor is introducing Android Automotive and developing a center display of various ratios according to customer preferences. It is also developing its own Android-based open OS and car app market, and through a conversational AI based on a super-large language model, it is developing and enhancing features to aid the safety and convenience of drivers in the car.

In terms of user experience, Hyundai Motor is focusing on developing its Digital Cockpit, which will feature next-generation user experience/interface (UX/UI) designs. These designs are expected to enhance the interface between the vehicle and its user, making it more intuitive and user-friendly.

From the first half of 2026, Hyundai Motor will sequentially apply the next-generation infotainment system based on Android Automotive Operating System (AAOS) to mass-produced vehicles. In the second half of 2026, the company plans to launch an SDV Pace Car equipped with the HPVC electronics architecture currently under development. This will implement faster and more stable autonomous driving and AI functions and demonstrate new mobility services and businesses. From then on, Hyundai Motor will expand SDV full-stack software technologies to other models, continuously improving and enhancing the driving experience in Hyundai models.

Hyundai Motor vehicles are set to transform into learning machines that continually improve through AI integration. This advancement will be based on data collected through SDVs. The integration will not only enhance driving, safety and convenience functions but also improve usability by constantly updating new app services. This seamless connection promises to integrate all movements in the user’s daily life, marking a significant leap in vehicle technology and user experience. Over-the-air (OTA) updates will create a virtuous cycle of data-driven SDV advancement with connected service enhancements and mobility service enhancements.

Hyundai Motor to launch Autonomous Vehicle Foundry Business: Hyundai Motor plans to launch a foundry business that will sell autonomous vehicles to various global autonomous driving software technology companies. This new venture will leverage the company’s hardware development capabilities and manufacturing competitiveness, building on its experience in developing autonomous vehicles through collaboration with Motional and expanding cooperation with global autonomous driving leaders.

Through these partnerships, Hyundai Motor aims to bolster its autonomous vehicle development and manufacturing capabilities to the highest global standards. It plans to develop a platform for essential common areas for implementing Level 4 or higher autonomous driving and intends to supply this autonomous vehicle platform to global autonomous driving software development companies.

Ultimately, Hyundai Motor will continue to promote the expansion of the foundry business using the secured autonomous vehicle platform, continuously enhancing its autonomous driving capabilities and securing profits. The company will expand its global presence centered on Motional’s autonomous driving technology.

By operating in the North American region using the second-generation robotaxi platform based on IONIQ 5, Hyundai Motor will strengthen its business operation experience and technological capabilities. This will enable the company to develop the third-generation robotaxi platform and the optimal vehicle model and expand the robotaxi service area to the global market.

Hyundai Motor is also establishing a sustainable R&D environment and diversifying revenue models such as sales, delivery, and advertising of Level 3 solutions based on leading autonomous driving Level 4 technical capabilities. This will allow the company to flexibly respond to changes in the autonomous driving market environment.

Safety is a top priority in Hyundai Motor’s development of autonomous driving technology. The company is establishing a system that collects autonomous driving data and continuously trains the AI model simultaneously. As the volume of data increases, Hyundai Motor will be able to implement safer and superior autonomous driving technology. A key element in the development of safe autonomous driving technology is the creation of a computing system that can safely control autonomous vehicles in any situation. To this end, Hyundai Motor is developing autonomous driving computing hardware that ensures stability and reliability, including functional safety and redundancy.

The company is concentrating on developing an end-to-end deep learning model that performs perception, judgment, and control all at once. This model is planned to be expanded and applied as a scalable global solution from Level 2+ to Level 4. Hyundai Motor is also continuously strengthening its internal capabilities for the internalization of the development of key elements of autonomous driving, striving to provide a safer and better customer experience for both drivers and pedestrians.

Hyundai Motor has been integrating all the technologies that go into cars, from autonomous driving to smart factories, into a single software platform to accelerate vehicle software innovation. The company is continuously enhancing SDVs step by step and is continuously improving vehicle quality and marketability by equipping vehicles with controller OTA functions.

Energy Mobilizer: A pioneering leap into a sustainable energy future with hydrogen: Through its hydrogen value chain business brand, HTWO, Hyundai Motor plans to expand its fuel cell system lineup to cater to different needs, covering wider applications such as trams/trains, advanced air mobility, heavy equipment, sea vessels and more. Some of the contributing growth factors include rising demand for clean hydrogen in hard-to-abate sectors including oil, cement and steel, as well as increasing utilization in long-range transportation, such as ships and airplanes.

Hyundai Motor is dedicated to leading the global energy transition through its HTWO business, focusing on sustainable energy technology and solutions. The company aims to achieve net zero by 2045, becoming carbon neutral across all stages of production and operation. This includes implementing renewable energy at work sites and expanding its hydrogen energy business.

Hyundai Motor views hydrogen as a pivotal element in its energy strategy, aiming to make it a readily available energy source for all aspects of life and industry, not just transportation. Hydrogen is an excellent clean energy carrier thanks to its high energy density, ease of storage and transportation. The company’s innovative hydrogen production methods, such as Waste-to-Hydrogen (W2H) and Plastic-to-Hydrogen (P2H), are being utilized globally. These methods produce clean hydrogen while also providing effective waste disposal solutions.

The HTWO Grid epitomizes Hyundai Motor’s integration of mobility and energy, offering a flexible, end-to-end hydrogen solution. Real-world applications of this technology are already underway, such as the NorCAL Zero Project and the Port Decarbonization Initiative, with plans to expand hydrogen applications to entire port operations. In the clean logistics business, Hyundai Motor is implementing solutions in North America and Korea, starting with HMGMA in Georgia.

Financial Highlights on Hyundai Way: At the event, Hyundai Motor’s CFO, Seung Jo Lee, outlined the company’s financial strategies. He announced Hyundai Motor’s mid- to long-term investment plan, profitability target, value-up program, and subsequent shareholder return policy, all crucial elements in successfully executing the ‘Hyundai Way’ strategy.

1. Forthcoming 10-year Investment Plans

Hyundai Motor has announced a total investment of KRW 120.5 trillion for the next decade, from 2024 to 2033. This is KRW 11.1 trillion more than what was announced last year. The investment breakdown includes KRW 54.5 trillion for Research and Development (R&D), KRW 51.6 trillion for Capital Expenditure (CAPEX), and KRW 14.4 trillion for strategic investments.

In alignment with the Hyundai Way strategy, which encompasses Hyundai Dynamic Capabilities, Mobility Game Changer and Energy Mobilizer, the company emphasized its investment plan, which will be implemented in phases.

Under the Hyundai Dynamic Capabilities strategy, the company plans to invest a total of KRW 92.7 trillion. This includes KRW 37.4 trillion for Research and Development (R&D), KRW 50.8 trillion for Capital Expenditure (CAPEX), and KRW 4.5 trillion for strategic investments. This investment aims to bolster Hyundai’s competitiveness in the era of electrification, focusing on hybrids, new EREVs, next-generation modular architecture and battery technologies.

Under the Mobility Game Changer strategy, Hyundai Motor plans to invest KRW 22.1 trillion in advanced software and E/E architecture, leveraging its expertise in hardware development and production. This investment is also intended to bolster the company’s future pursuits in autonomous driving, software-defined vehicles, and robotics.

Under the Energy Mobilizer strategy, Hyundai Motor plans to invest KRW 5.7 trillion to develop hydrogen ecosystems and value chains, further enhancing its existing expertise in hydrogen energy.

2. Mid- to long-term Financial Goals

Hyundai Motor targets an operating profit margin of 9 to 10 percent in 2027 and over 10 percent in 2030 through continuous cost enhancements for EVs and the introduction of EREV models.

The company expects to achieve equal profitability on its entire powertrain lineup, including ICE, hybrids, EREVs and EVs by 2030.

3. Expanding Shareholder Return Policy

Hyundai Motor plans to bolster its corporate value by implementing a total shareholder return (TSR) concept. This system includes dividends, as well as the cancellation and buyback of treasury stocks.

Starting from this year, Hyundai Motor has committed to paying a minimum annual dividend of KRW 10,000 to its shareholders. The company also plans to transparently communicate its rationale for share buyback, by either enhancing Hyundai Motor’s corporate value or distributing the stocks to its employees.

From 2025 to 2027, Hyundai Motor will employ a proactive and sustainable TSR of more than 35 percent. This will involve a flexible approach between the sum of dividends, buybacks and cancellations of treasury stocks. During this period, the company aims to achieve an average ROE of 11 to 12 percent.

Over the next three years, Hyundai Motor will initiate a stock buyback program worth up to a total of KRW 4 trillion, in accordance with the TSR. The annual amount will be flexibly determined based on the company’s return on equity (ROE) targets.

Additionally, Hyundai Motor will offer a minimum quarterly dividend of KRW 2,500, representing an increase of 25 percent compared to the current year. In instances of retiring or repurchasing treasury shares, the company will also consider the value of its preferred stocks.