JETRO asks Indian firms to acquire Japanese SMEs, invest more in Japan to increase their number in India, promote business relations

India has an abysmally low presence of Japanese SMEs in India at 20% of the total Japanese companies as against China, ASEAN, and Bangladesh where they are 40-60% of their total number.

NEW DELHI: Concerned over very low presence of Japanese small & medium enterprises (SMEs) in India, the Japan government-run Japan External Trade Organization (JETRO) has coined an out-of-box idea for increasing their influx into India.

JETRO India’s Chief Director General Takashi Suzuki recently said that Indian companies acquiring Japanese SMEs, (even if these are sick but technology-wise sound) and they investing in Japan, could be one of the kick offs to promote bilateral business relations, and to raise the number of Japanese SMEs in India.

While drawing a reference from Indian conglomerate Vedanta investing in a sick Japanese company manufacturing LCD glass substrate AvanStrate Inc (ASI), and acquiring it sometime in 2017-18, Suzuki said, “Vedanta acquired this sick Japanese company but it had a good technology. It’s rally strategic. I know that it’s a bit controversial that a Japanese government organisation JETRO is asking Indian companies to acquire the Japanese SMEs. But it might be a good idea to regard such kind of articulately as a part of the collaboration. We also seek that Indian companies invest in Japan, and the type of the business can be one of the kick off to increase the business relations.”

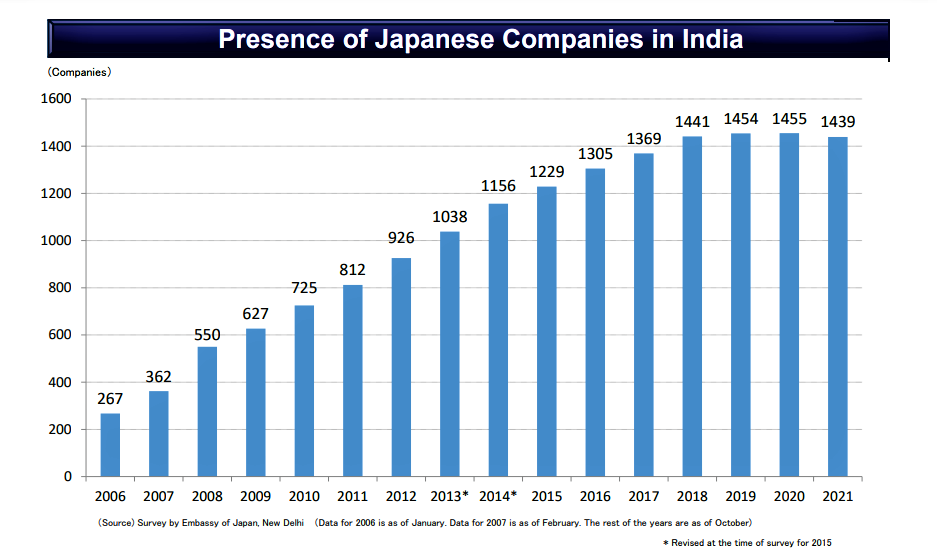

Suzuki said that Jetro’s leading concern was how to increase the number of SMEs in India. While highlighting a very unique elements of Indo-Japan business relationship, he said that India had more than 1400 Japanese companies but the SMEs here were only 20 percent of the total number.

| Country/Region | Total number of Japanese Companies | Percentage of Japanese SMEs |

| China | 13,000-15,000 | 40-60 |

| ASEAN | 13,000 | 40-60 |

| India | 1439 | 15-20 |

| Bangladesh | 338 | 40-60 |

“In deep contrast, the Japanese SMEs are more than 50 percent in China, ASEAN or even in Bangladesh. It’s Jetro’s leading concern as to how to increase the number of SMEs in India, and efforts on this front in the last decade did not bear fruits,” Jetro India chief added.

While commenting on the subject of outward foreign direct investment (FDI) from India to Japan, Suzuki said Japan needed more digitalisation in industry of super aging society, and therefore healthcare, elderly care or social care related services were the huge opportunities for Indian companies in Japan.

“Also in the green hydrogen and renewable energy sector, the big Indian companies like Adani, Reliance or others are making trillion of rupees investment already, these are the big name the Japan corporate can have joint projects with. Or may be, they can take them to Japan, and also the semiconductor could be one of the most interesting field to invest in Japan,” he added.

Suzuki also mentioned Vedanta’s recent visit to Japan when it signed MOUs with 30 Japanese companies for development of India’s semiconductor and glass display manufacturing ecosystem.

Suzuki also mentioned Vedanta’s recent visit to Japan when it signed MOUs with 30 Japanese companies for development of India’s semiconductor and glass display manufacturing ecosystem.

In Japan, Akarsh K. Hebbar, Global MD, Display and Semiconductor Business, Vedanta along with Dr. Alan Tsai, CEO, Avanstrate Inc unveiled a comprehensive manufacturing plan. Hebbar said, “We are committed to making India a hub for electronics manufacturing. Vedanta is focussed on taking the lead in creating the electronics industry ecosystem. This comprehensive plan has potential to generate business opportunities of over $40 Bn for our partners in the coming years.”

This article will be whistle blow to Japan Government in Tokyo.

To request indian firm to acquire Japan SME s just create unstable status of far east.

Now in Japan is under emphasising the military industry and key is SMEs who has special skill of manufacturing.

Analysis of Jetro India is too much poor. Just Non sense.